A drastic change was needed, but was the shift to Windows Phone - an unproven smartphone OS from Stephen Elop's former employer - the correct choice? Let's take a look at how Nokia has been performing financially, ever since Stephen Elop took over (third quarter, 2010) to today.

|

| Nokia Revenues Q3 2010 to Q3 2012 |

The above graph plots Nokia revenue & net profit over Q3 2010 to Q3 2012. In Q3 2010 Nokia earned approximately 10 billion euros in revenue, and only 322 million in profits. Not the best performance for a quarter - earning just a few hundred millions for over ten billion in sales means that something needs to change in the company. That "something" would probably be controlling costs, increasing ASP (Average Selling Price of handsets) by focussing more on smartphones, and getting rid of businesses that were burning cash.

In the fourth quarter, 2010, Nokia's revenues rose sharply to 12.6 billion euros. A great quarter, even when you factor in the seasonality (Q4 usually has stronger sales due to the Western holiday season). It also earned a decent 700 million euros in profit. At this point it should have been clear to anyone studying the company performance that there is a demand for their products. Yes, analysts were screaming that Symbian is aged, slow, and does not stand a chance against Android, but that did not change people's buying behaviour. Q4 2010 showed that people did not care much about what these analysts said, and would buy a Symbian phone if it looked good. Most of these analysts were based in the US, and had no idea of Symbian's domination in China, India, and South-East Asia. I personally think that the Q4 2010 results were good because of the sales of N8 - one of the best Symbian phones ever made.

Then came 11-Feb-2011, and Stephen Elop's announcement that Nokia would transition to Microsoft's Windows Phone as it's main and only smartphone OS platform. Symbian would die a slow death (he hoped), while Meego - the Linux based OS Nokia & Intel had been working on - would be nipped in the bud. To be frank, when I first heard this decision I did not think it was wrong. It did seem to be "technology nepotism" - i.e. Stephen Elop favoured buying a technology from his former employer, Microsoft, rather than choose Google's Android. But I didn't think that this technology nepotism was a bad thing. Everyone who has ever sourced software for his company knows that it's always better to get it from a vendor that you are well connected with - i.e. you know that you can pick up the phone and call your counterpart in the other company to discuss critical issues. However, as the months went by, I realized how wrong Elop's obsession with Windows Phone was.

Q1 2011 onwards, Nokia revenues started falling. It fell for three straight quarters while the industry grew. It even reduced Nokia to a loss making company. A brief spike in Q4 2011 brought some hope, but it was not sustained. Over the last three quarters - Q1 to Q3 2012 - Nokia's revenues have stayed more or less steady at 7 billion euros (30% less that what it was when Elop took over). But what is more concerning is that billion euro losses per quarter have become the norm. Where are these losses coming from?

The graph above plots the revenues & operating profits for Nokia "Devices & Services" business. This helps to show where the fall in revenue & profitability are coming from, as it removes Nokia-Siemens Networks, and "Location & Commerce" businesses (L&C is small enough to be ignored, in anycase).

This graph reveals interesting details - firstly, majority of Nokia revenues used to come from Devices & Services business. This is expected, because Nokia is a mobile handset maker, and this is the "meat" of their business. However, as of Q3 2012, Devices & Services are earning just 49% of Nokia total revenue. In Q3 2010, Devices & Services earned about 7 billion of the 10 billion revenue, while NSN came in with 3 billion. In Q3 2012, NSN still brings in about 3 billion a quarter, while Devices & Services revenues have fallen from 7 to 3.5 billion. Clearly, the drop in revenue is because of Devices & Services. And the revenue decline starts soon after the Feb-11 announcement of strategy change. What has happened is that the demand for Symbian phones fell overnight when Stephen Elop announced publicly that they were not good enough. This has been called the Ratner effect by Tomi Ahonen in his blog. Interestingly, the demand for Meego did not fall overnight. The Meego-based N9 had surprisingly good reviews everywhere. In my experience the last Nokia phone to get such excited response form the market was the N95 - a super-loaded phone which had everything that a consumer could want from a phone at that time. But Nokia refused to sell the phone in any relevant market. I believe this was mandated by Microsoft, as MS hates anything that is based on Linux.

Later, when the Nokia "Lumia" range of Windows Phones were launched, they did not generate enough enthusiasm in the market to boost sales. So we have the situation toady that Nokia sales are lower than 2 years ago (before they shifted to Windows Phone), and shows no sign of improving. The company is also making losses at an alarming rate. I do expect Q4 2012 to be better - partly due to seasonality - but my estimate is about 8 billion euros in revenue, and maybe the company returns to profitability by the skin of it's teeth. Nowhere near the 12 billion revenue & 700 million profits in Q4 2010.

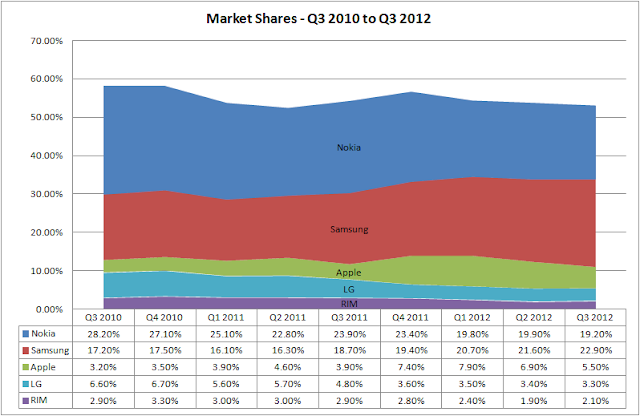

We now have a situation where a major strategy change in Nokia has driven down it's revenues and profitability. But maybe Elop's strategy was to sacrifice these in favour of market share? So how does Nokia's market share look like over the same period? The graph below tracks market share (all data from Gartner releases).

Well, it's fallen to second place. In effect, it has just exchanged positions with Samsung. Nokia had 28% in Q3 2010, and has 19% in Q3 2012. Samsung had 17% in Q3 2010, and 22% in Q3 2012. But this does not show the true picture, because it includes all phones - smart and feature. The industry has moved on since 2010 to favour smartphones over feature phones. It is critical for the success of a handset maker to make sure that the smartphone to feature phone ratio is increasing. So how does it look for Nokia?

Not good, unfortunately. Smartphones volumes started dropping from Q1 2011 (as soon as the strategy change was announced), and is now selling only 6.3 million a quarter. In 2010, Nokia sold an average of about 25 million smartphones a quarter. It had ended 2010 with an almost 50-50 revenue distribution between smartphones and feature phones (area graph above). It ends 2012 with this reduced to 30-70. This is one handset manufacturer that is running in reverse gear!

What happened to Nokia is that it's customers have rejected the Windows Phone OS. Whether it's operators in operator-centric markets, or the end users in non-operator-controlled markets - Windows Phone is not wanted anywhere. Take a look at the smartphone OS market shares (all data from Gartner press releases)

Windows phone share is so small that I had trouble selecting it in excel to format the series in the graph! Android has quickly taken advantage of this Nokia mis-adventure.

It takes no expert to see that Nokia's Windows Phone strategy is not working. The numbers above do not lie - they were all taken from Nokia's own investor relations page (except the market shares, which were from Gartner). In Q1 of 2013, it will be a full 2 years since Nokia adopted the Windows Phone strategy. It does not take this long, really. Not in the smartphone industry!

The correct thing for Stephen Elop to do in Q1 2013 is to announce that Windows Phone has had extremely limited success, and is bleeding the company. Hence, the decision to sell Windows Phone only in North America. Nokia would return to home grown OS'es. Meego phones would be released everywhere. Symbian would be tinkered with to improve the UI, and released in cost-sensitive markets like India, China & SE Asia. Some people think that Stephen Elop will never do this, as he is either an insane CEO, or is still working secretly for his former employer - Microsoft. I personally do not believe this - I think he's just a CEO who is inexperienced in the idiosyncrasies of the mobile phone industry. He came from an old-technology company that moved in a much more leisurely pace. But he must have learnt from his mistakes so far. Let's see what his New Year's resolution is in 2013.

2 comments:

It Would be nice to see pre-Elop year in the graphs. Let's say Q3 2009 onwards. Now we know Nokia switched the strategy but do not e.g. see the rise of Android and drop of Nokia market share behind it.

@Anonymous: Firstly sorry for leaving your comment hanging for a while. I see that it was made on 20-April, while I am publishing it on 3-May. Somehow Google/Blogger does not send an email alert if there are comments waiting to be moderated.

The point you make is, of course, relevant. I would take some time out to extend this analysis over to pre-Elop years as well. I would assume that it would shows Nokia's share of the smartphone market dropping with the launch of iPhone in 2007, and Android in 2008. But the financials would still be strong, i.e. growing revenues, and profits.

Post a Comment